Some Known Questions About Instant Cash Advance App.

Wiki Article

Things about Instant Cash Advance App

Table of Contents5 Easy Facts About Loan Apps ExplainedThe Greatest Guide To Instant Cash Advance AppWhat Does Instant Cash Advance App Mean?5 Easy Facts About Best Personal Loans DescribedHow Best Personal Loans can Save You Time, Stress, and Money.The 5-Minute Rule for Instant Loan

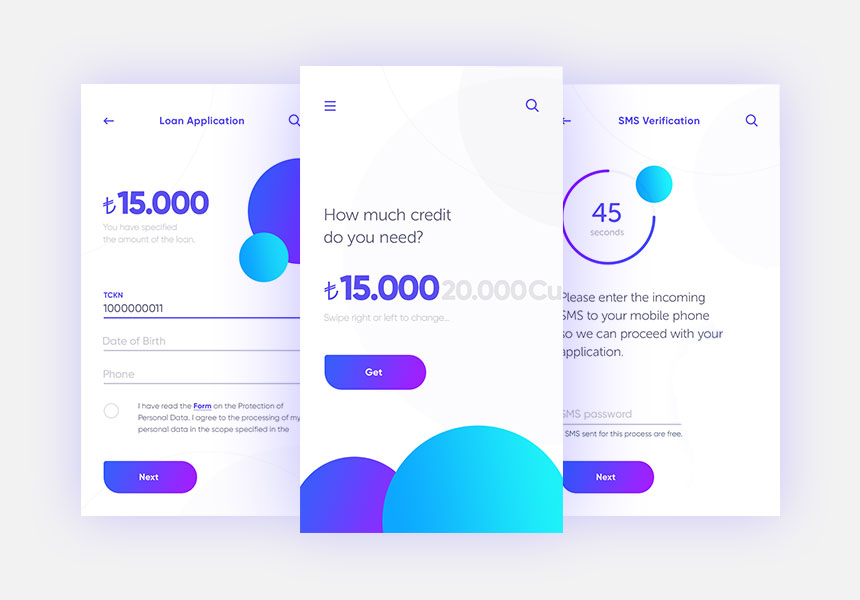

When we believe concerning obtaining financings, the images that comes to mind is people aligning in lines up, waiting for numerous follow-ups, and also obtaining absolutely annoyed. But modern technology, as we understand it, has changed the face of the loaning service. In today's economic climate, debtors and also not lending institutions hold the key.Financing authorization and paperwork to lending handling, everything is online. The lots of trusted online lending applications offer borrowers a platform to get loans quickly and also give authorization in minutes. You can take an from a few of the very best cash car loan apps available for download on Google Play Store and Application Shop.

You just have to download the application or go to the Pay, Feeling site, sign up, post the called for files, and also your car loan will obtain accepted. You will certainly obtain notified when your finance request is processed.

Not known Details About Instant Cash Advance App

Often, even after obtaining your car loan accepted, the procedure of obtaining the lending quantity moved to you can take some time and get made complex. That is not the case with on the internet finance applications that use a direct transfer option. Immediate finance apps use instant personal finances in the variety of Rs.

5,00,000 - instant cash advance app. You can avail of an instant lending according to your eligibility as well as require from instant car loan apps. You don't have to worry the following time you want to avail a small-ticket funding as you understand just how advantageous it is to take a financing making use of on-line car loan applications. Do away with the taxing and also tiresome process of availing of conventional individual loans.

All About $100 Loan Instant App

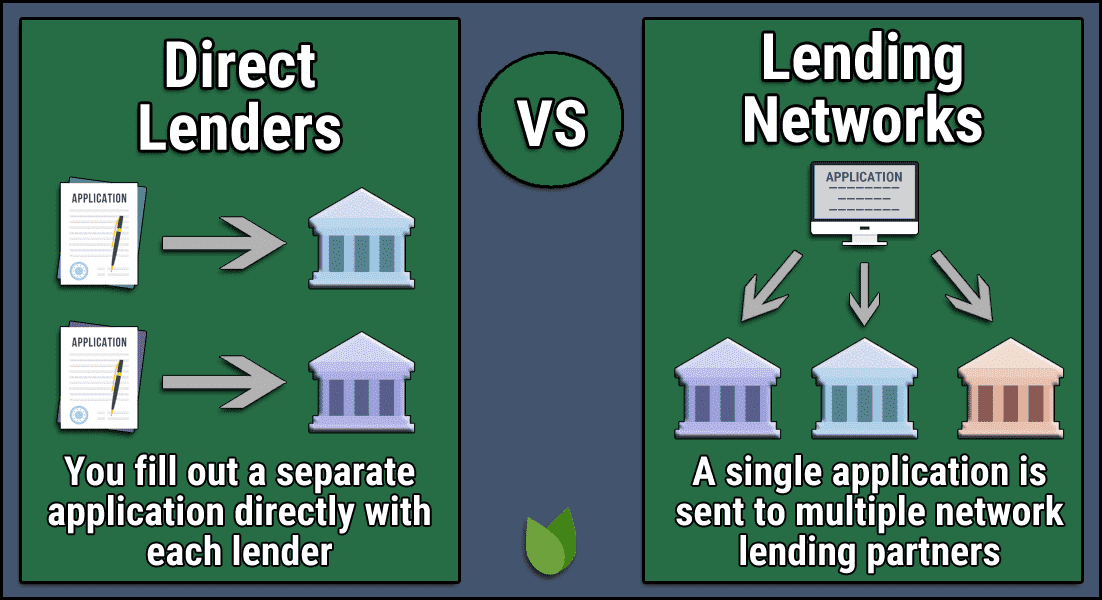

By digitizing and automating the financing process, the system is changing traditional banks into digital loan providers. In this post, allow's check out the advantages that an electronic borrowing system can bring to the table: what's in it for both financial institutions and also their customers, and just how electronic loaning systems are disrupting the market.Every bank currently go now desires every little thing, including lendings, to be processed instantaneously in real-time. Consumers are no much longer ready to wait for days - not to mention to leave their houses - for a loan.

8 Simple Techniques For $100 Loan Instant App

Today's Gen, Z as well as millennials can not live without their mobile phone. All of their everyday tasks, including monetary transactions for all their activities as well as they favor doing their economic purchases on it also. They want the benefit of making transactions or looking for a funding anytime from anywhere. It's very challenging to please.In this case, electronic loaning platforms work as a one-stop solution with little hands-on information input as well as quick turnaround time from loan application to money in the account. Customers need to be able to relocate seamlessly from one tool to an additional to complete the application types, be it the web as well as mobile user interfaces.

Carriers of digital loaning platforms are required to make their items in compliance with these policies as well as aid the lenders focus on their company only. Lenders additionally should see to it that the providers are upgraded with all the most recent guidelines provided by the Regulators to swiftly include them into the digital lending platform.

See This Report about Best Personal Loans

The typical hands-on loaning system was a pain for both lender and Read More Here also borrower. Customers had to make several journeys to the banks and send all kinds of records, as well as by hand load out a number of types. instant cash advance app.The Digital Borrowing platform has actually transformed the means financial institutions believe about as well as execute their car loan purchase. Banks can now release a fully-digital loan cycle leveraging the current advancements. A fantastic electronic loaning system should have simple application entry, quick authorizations, certified borrowing processes, view it as well as the ability to constantly boost procedure effectiveness.

Customers will certainly have to resort to non-bank sources of financing." It is very important to keep in mind that loaning is an extremely successful fintech field, where 28% of the top 50 fintech companies operate. So if you're thinking about going into financing, these are soothing numbers undoubtedly. At its core, fintech is everything about making standard monetary procedures quicker and a lot more reliable.

An Unbiased View of $100 Loan Instant App

One of the common misunderstandings is that fintech apps only profit banks. That's not entirely real. The application of fintech is now spilling from financial institutions as well as lenders to small companies. This isn't unexpected, since little businesses need automation and digital technology to maximize their limited resources. Marwan Forzley, chief executive officer of the payment platform Veem, amounts it best: "Local business are aiming to contract out intricacy to somebody else due to the fact that they have enough to fret about.As you can see, the convenience of use covers the listing, revealing exactly how availability as well as comfort supplied by fintech systems stand for a substantial motorist for customer commitment. You can use numerous fintech advancements to drive consumer trust as well as retention for businesses.

Report this wiki page